How we got free flights to New Zealand and saved $4,000

(This is a re-post of a blog post I wrote back in 2017. I haven’t yet cross referenced links to see if these bonuses and whatnot are still available, so please make sure to do so before signing up for any credit cards)

Before marriage was even on the table for Jay and I, we both expressed the desire to go to New Zealand someday. With Hobbtion for film-loving Jay and the best mountains in the world for mountain-obsessed me, it was the ideal place to go to while we were still young and kid free.

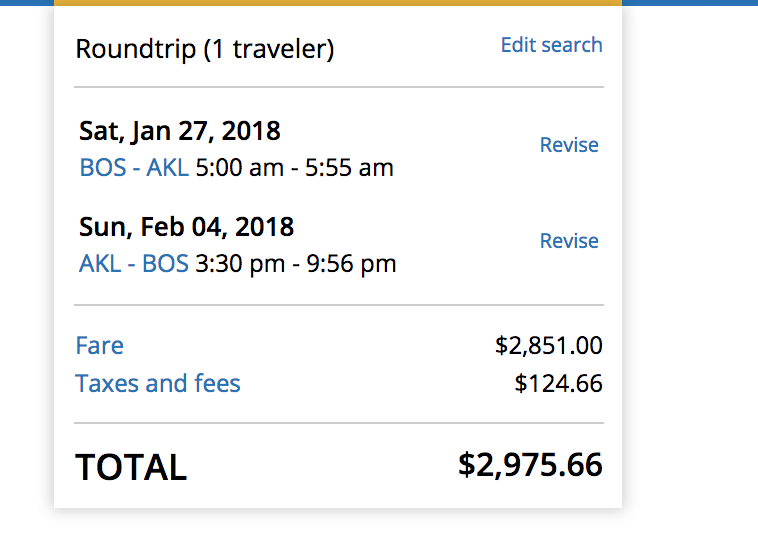

Then we checked flight prices.

At a whopping $2,000+ PER PERSON, it was a hard pill to swallow. Between my 19 months of die-hard dedication to debt freedom, our engagement, the purchase of our land, and then getting married, it was just never a feasible expense for us to take on.

Of course, getting married prompted the honeymoon discussion, and it was obvious where we wanted to go. Jay and I agreed that spending $4,000 on flights, while now trying to build a house, wouldn’t be a wise decision, but surely there was an affordable way to visit. So, being the deal-seeking crazy lady I am, it was time for some research.

With the help of a few Google searches and the subreddit /r/awardtravel, I devised a plan that would get us FREE flights to New Zealand, savings us that $4,000. Just how I did it is outlined in the rest of this post below.

Disclaimer: the following method requires somewhat decent credit and the ability to sign yourself up for two credit cards. If this is not feasible for you or simply not something you want to do, than this post probably won’t be helpful.

I started this whole method back in February (of this year, 2017), while we were still in the midst of planning our wedding. Because New Zealand’s seasons are opposite of ours, we knew we would have to wait a bit after our September wedding in order to experience New Zealand in its summer/warmer months (December-March). This worked out perfect for us, however, since it took until just now (December) in order to obtain the points we needed to book the flights.

If you’re looking to book your trip within the next few weeks, you’ll either have to have some seriously major expenses coming your way, or hold off your trip because each card has a minimum spend amount within 3 months. Even if you meet the minimum spend in, say, 1 month, you still won’t get the points until the 3 months is up. I’ll elaborate more on this as the post goes on, however.

Financially, we only had enough monthly expenses to focus on one card at a time, so we started with me.

KELSEY’S PLAN CARD 1:

On February 7th, 2017 I signed up for the Chase Sapphire Preferred Card - it has a $95 annual fee (well worth it for what you get back with this card) that they actually waive for the first year.

Upon signup, you are automatically enrolled in their bonus point sign-up offer as part of their card perks - there’s no special landing page you need to sign up at or email list you need to get on. Additionally, because I’m sharing all this and you love me, you can sign up for the card via my referral link here (and still get the same amount of points): https://www.referyourchasecard.com/6/AFA9TSHPO2

You receive 50,000 bonus points AFTER you spend $4,000 on purchases within the first 3 months from account opening.

That sentence right there is key. It sounds daunting, but consider your monthly bills/expenses for the next 3 months and you’ll more than likely meet that minimum. Add in spending money or any large purchases you may be planning to make and it makes it even easier.

For us, I used the card as a debit card essentially and just paid EVERYTHING with it. Our rent, which is $950/mo, is paid via the Square Cash app every month (similar to Venmo). Instead of using my debit card, I used the CSP card, paid the credit card transaction fee (about $20), and had $2,850 of the $4,000 cover right there. Another big expense was groceries, which added on another $540+ after 3 months. Since we were also paying for a wedding, deposits and all the little spending here and there really added up - so much so, that I didn’t even bother switching other monthly expenses, like electric or internet, to the credit card.

One thing to note is that we NEVER paid a cent of interest and I made sure to pay the card in full every month. This had been a point of contention for me and I contacted Chase’s customer service, to make sure we didn’t need to have $4,000 of debt on the card, in order to receive the points. They assured me that I could spend and pay off the card as needed and did not have to carry a balance to get the sign-up bonus.

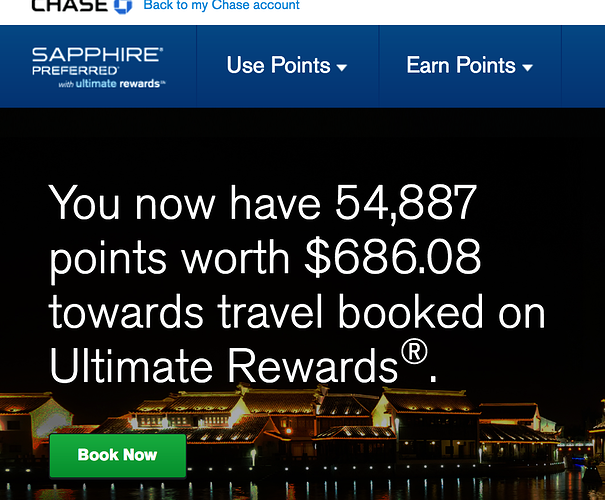

Within 3 months, we achieved the minimum spend amount and received our 50,000 points on the following statement. We even got some additional points for adding Jay as an authorized user, which I'll go into more detail about later in this post.

This equaled out to $686.00 worth of points, and all we had to do was spend money as normal.

KELSEY’S PLAN CARD 2:

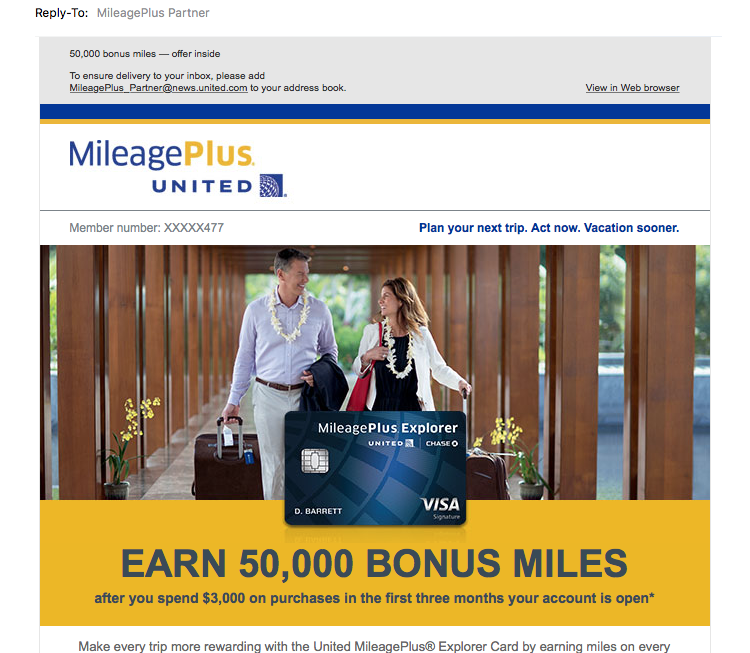

The next card I needed to sign up for was the United MileagePlus Explorer card. In order to get the maximum sign-up bonus this card offered, which was 50,000 points, there was one extra step involved. It’s not necessary, as you’d get enough points with just the normal 40k bonus, but at the time I wanted to make sure I was getting as many points as possible, just in case the flights were more than expected.

On January 30th, before I even signed up for the Chase Sapphire Preferred Card, I made an account with United MileagePlus here - https://www.united.com/ual/en/us/account/enroll/default

This is not the sign up page for the actual credit card, but instead a page for the MileagePlus account you will be transferring all points to and booking your flights with. In addition to that, however, signing up for this account prompts United to target you for an email offer - the 50,000 points.

Sure enough, on February 21st, I was targeted for the 50,000 points email.

Since the offer told me to apply by March 15th, I decided to wait it out for as long as I could, since I had just recently signed up for the CSP card I talked about above. We certainly didn’t have $7,000 of expenses every month, so trying to meet the minimum spend requirements for two cards at the same time wouldn’t have worked. I marked my calendar for March 15th while I continued to work on the CSP.

Well wouldn’t you know on March 7th, just a few days before I had to sign up for the United card, MileagePlus sends me another email offer - this time for 70,000 points. Score.

Once again, I wait until the last possible day to sign up, which was March 30th per the email. Not because I was hoping they’d send me another offer (though wouldn’t that be awesome), but because it just gave me more time to finish up with the CSP card.

So on March 30th, my United MileagePlus card was on its way.

For this card, you receive 50,000 bonus points (or in my case 70,000) after you spend $3,000 on purchases within the first 3 months from account opening.

This card also has a $95 annual fee that they do not waive the first year, unlike the CSP card. Per some advice I had received in the past, I called them up and asked if it was something they would consider waiving regardless, but was unsuccessful. They explained the perks you get with card (like free checked bags on flights) were worthy of the annual fee and therefore they don’t ever waive it. It certainly never hurts to try, though!

Only having to spend $3,000 within the 3 months this time was easily achievable, and we were ready to move on to Jay’s plan.

JAY’S PLAN CARD 1:

For Jay, we mixed things up a bit and did the United card for him first - I wanted his MileagePlus account all set up and ready to go in case some crazy deal came up or we needed to book flights earlier for whatever reason.

I admittedly was a little late in asking him to signup (slightly preoccupied with an upcoming wedding), and since we were on a strict timeline of needing to book flights for the end of January, we skipped the targeting email that I had done for myself (since it takes a couple of weeks to get it). Despite missing out on potentially 70,000 points, he would still be getting enough to cover what we’d need for our trip.

Once again, after 3 months and $3,000 worth of purchases (and final wedding expenses), he received his 50,000 bonus points. It was time to move on to our final card.

JAY’S PLAN CARD 2:

Being the crazy deal lady that I mention at the beginning of this post, I found yet another way to maximize the points Jay would receive after signing up for his Chase Sapphire Preferred Card - through referral!

Many Chase cards offer a referral bonus for friends and family who sign up via a link you provide them. You get an additional 10,000 bonus points per each person you get to sign up for the card, up to 50,000 points max per year.

So, signing him up for the CSP card via my referral link got him his 50,000 bonus points (after the spend $4k in 3 months condition) and me an additional 10,000 bonus points on my next statement. Couldn’t get much easier than that!

Since it was sometime towards the end of September that he signed up, our wedding had since been paid for and done, so all we had left to spend were regular living expenses and 4 flights to Orlando for Jay, myself, his sister and her boyfriend. Still, we managed to meet the minimum spend requirement and completed our last card by the end of November.

With each card "completed," all that was left to do was wait for all the points to come in, transfer the points to our MileagePlus accounts, and book the flights. Before getting to that, however, I found one more way to get a few thousand points extra.

AUTHORIZED USERS

During this whole year of working this plan, we each signed up to be an authorized user on one another’s cards, gaining an additional 5,000 points per card.

You receive 5,000 points for every AU you add, but AU’s should always be carefully considered. An authorized user has the power to use their own card under your account, and could potentially leave you high and dry in debt you never intended on being in.

Since we're married and both financially responsible (spoiler alert, I handle the finances), it only made sense for us to do this. You can never have too many points!

BOOKING THE FLIGHTS

At the end of it all, I had collected somewhere around 180,000 points while Jay had around 155,000 points - more than enough to book our economy flights to New Zealand. In order to do so, however, you have to do some transferring of the points.

Initially, the people helping me on Reddit told me to transfer ALL of the points to ONE of our MileagePlus accounts - that way, we could book both flights at once. Additionally, booking with the MileagePlus account would give us some great benefits, like free checked bags.

When trying to transfer Jay’s MileagePlus account points to my MileagePlus account, however, there was a massive fee of $900! This completely defeated the purpose of trying to get free flights, so I did some more investigating and came up with a new solution, one that involved us booking the same flight separately.

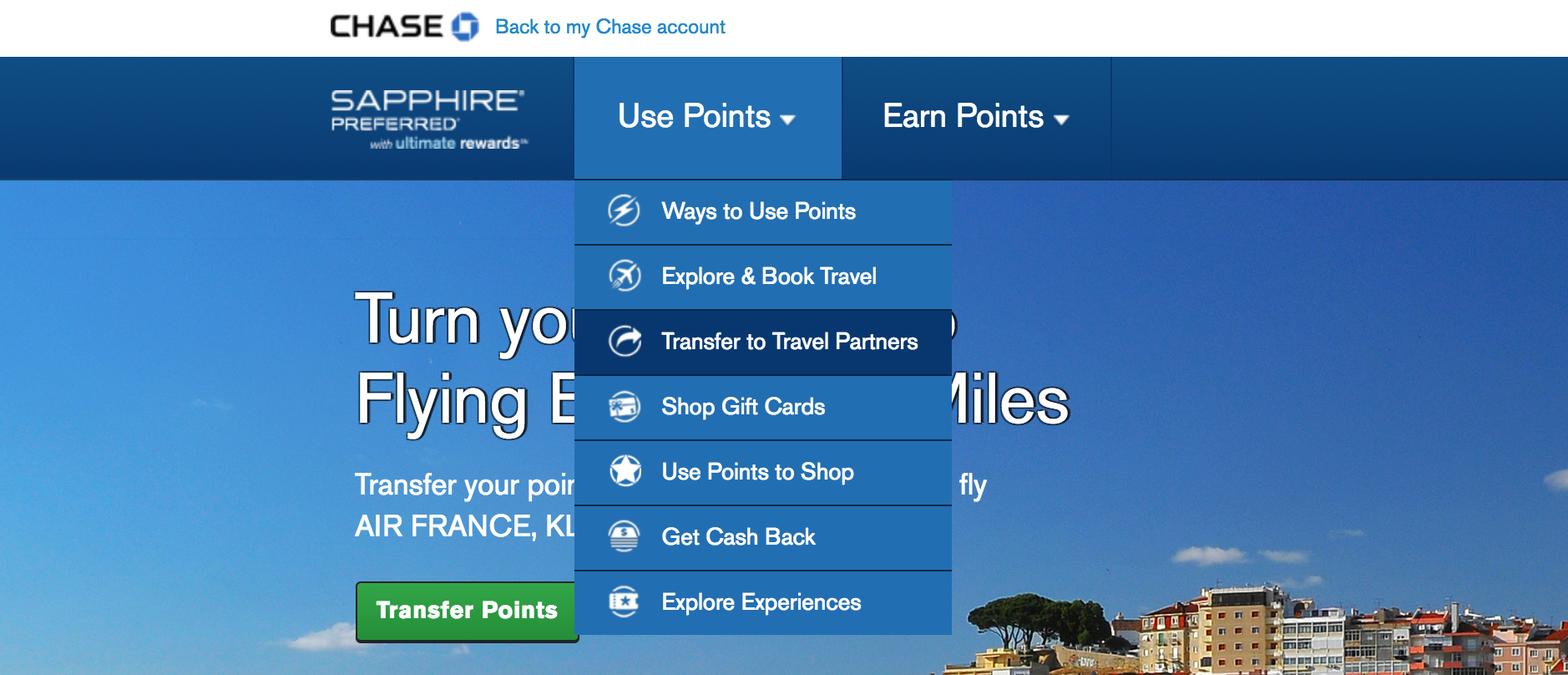

To start, I transferred the points I had collected from my Chase Sapphire Preferred card, to my MileagePlus account. CSP makes it easy - just go to your points page, click on “use points,” then select “transfer points” to prompt the transfer page. It will ask you for your MileagePlus number (which can be found on your card) and you’ll be good to go! Thankfully, there are no fees for transferring from Chase to MP.

Next, I repeated the steps above for Jay’s CSP points, transferring them to HIS MileagePlus account.

With all my points in my MP account and all his points in his MP account, it was time to book the flights. For clarity's sake, you must book the flights through the United MileagePlus website, meaning you'll be flying United Airlines.

Despite booking on two separate accounts and on two different cards (our United MP cards), we still managed to get the same flights and select the seats next to one another. I did it myself, using two different laptops, so that I could go through the steps simultaneously.

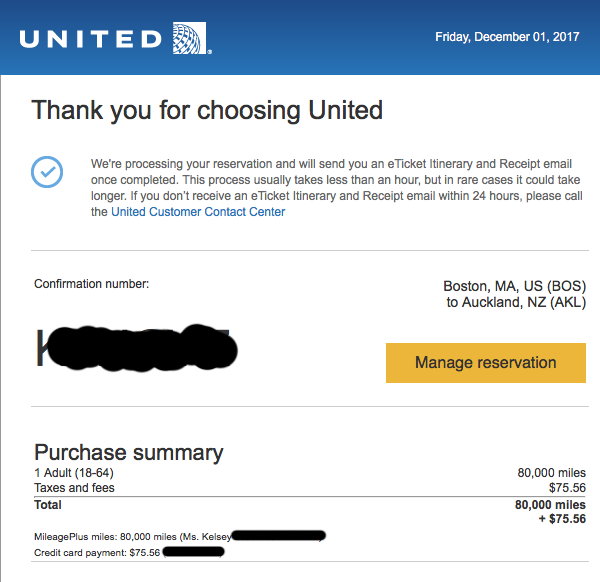

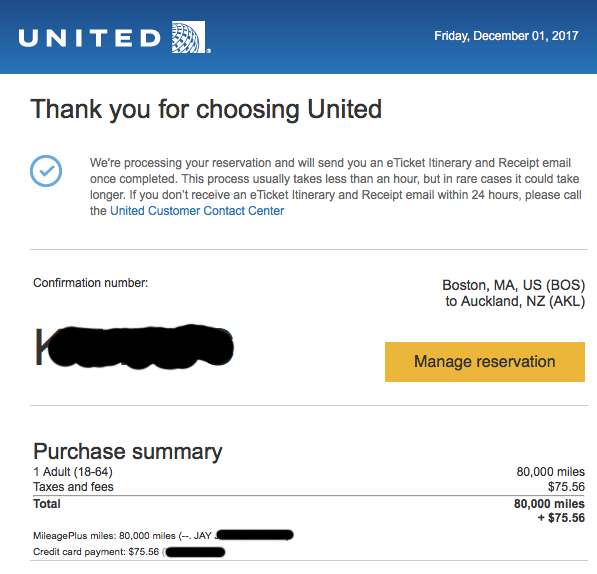

Within minutes, our flights to New Zealand this January were booked for the mere cost of $75.00 each - the cost of taxes/fees that points won’t cover - saving us roughly $4,000 total.

For ONE person, each way (depart and return) was 40k points - so 80k points total, per person. Even after booking these flights, we've got ourselves a decent amount of points left over for a trip in the future.

This plan doesn't just work to go to New Zealand, but any other place you desire. There's a lot to be gained with credit card sign up bonuses as long as you remain diligent and can keep track.

It took tons of research, patience, and a year of spending, but it was absolutely worth the wait. See you in January, Hobbiton!

Professional web developer & designer with a passion for crafting, DIY, and all things Pinterest.